financing project type classification method in banking sector in malaysia

Malaysias two tier health system of a heavily subsidised public sector and a user charged private sector has produced a progressive health financing system. This sector includes all industries in Section D classified under the Malaysia Standard Industrial Classification MSIC 2008 Ver.

Pdf Islamic Banking And Economic Growth In Gcc East Asia Countries

Chapter 5 Financial System of Malaysia 51 Financial System Structure in Malaysia The Malaysian financial system is structured into two major categories Financial Institutions and Financial Market.

. A Framework for Classification And Analysis Part II of this report. The RBA guidance for the banking sector was drafted by a group of FATF members co-led by the UK and Mexico. Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009.

Banking Sector1 The financial crisis in Asia has shown that a robust. The Bandar Malaysia mixed-use development which spans a gross floor area of over 12 million square feet and which is expected to be the single largest city development project in the Southeast Asian region remains a highlight in Malaysias real estate sector with construction of the first phase being anticipated to commence by June 2021. Different types of funding are used at each stage of the life cycle of real estate project finance.

The amount of deposits and loans supporting the economy were RM1642 billion and RM1318 billion respectively in that year. Classification of Loans by Sector Year 2006 - 2018 XLS Paling Popular. Classification of Loans by Sector Paling Popular.

Sector specific education or research activities eg. The Financial Institutions comprise Banking System and Non-bank Financial Intermediaries. Ranked lists show the leading firms in diverse parts of the financial industry.

Bank Negara Malaysia BNM reports that for 2014 a decade after the consolidation exercise the banking industry is reported to have a net profit RM32 billion with a 8 per cent contribution to the national income. This is aimed at providing a conducive environment for the sustainable growth of the. The role of Bank Negara Malaysia is to promote monetary and financial stability.

Agricultural education or construction of infrastructure eg. Agricultural storage should be reported under the sector to which they are directed not under education construction etc. TOWARDS A SUSTAINABLE BANKING SECTORMALAYSIA Merchant Banks.

Malaysia has one of the highest levels of financial inclusion in the world at 92 per cent and the country has taken advantage of mobile phones and online banking to expand access. The Financial Market in Malaysia comprises four major markets namely. Development of an inclusive financial sector is key to building shared prosperity as access to finance is critical to the ability of small entrepreneurs to grow.

The case of Malaysia exemplifies that policy makers can gain an in depth understanding of the equity impact in order to help shape health financing strategies for the nation. The FATF will also review its other RBA guidance papers all based on the 2003 Recommendations. Malaysia financial services subsectors Asset management Banking Digital finance Financial markets and instruments Financial regulation Insurance Key forecasts Overview.

Private financing sources Public sources of financing Federal programs for specialized projects State-by-state opportunities PRIVATE FINANCING SOURCES For most projects private financing is the easiest to attain. This revised version focuses on the banking sector. We then use bootstrap regression to examine the impact of origins on bank.

For overall year 2020 Malaysias GDP contracted 56 per cent as compared to 43 per cent in 2019. But modern research points to the fact that such opinion may be quite biased. There are several stages in a real estate development project.

28437 79661 12327 27023 102546 085 095 129. Bridging loan BL helps to bridge developer cashflow during construction and pending receipt of sales proceeds from end-purchasers andor their end-financiers. Commercial banking institutions remain the largest providers of financing to SMEs.

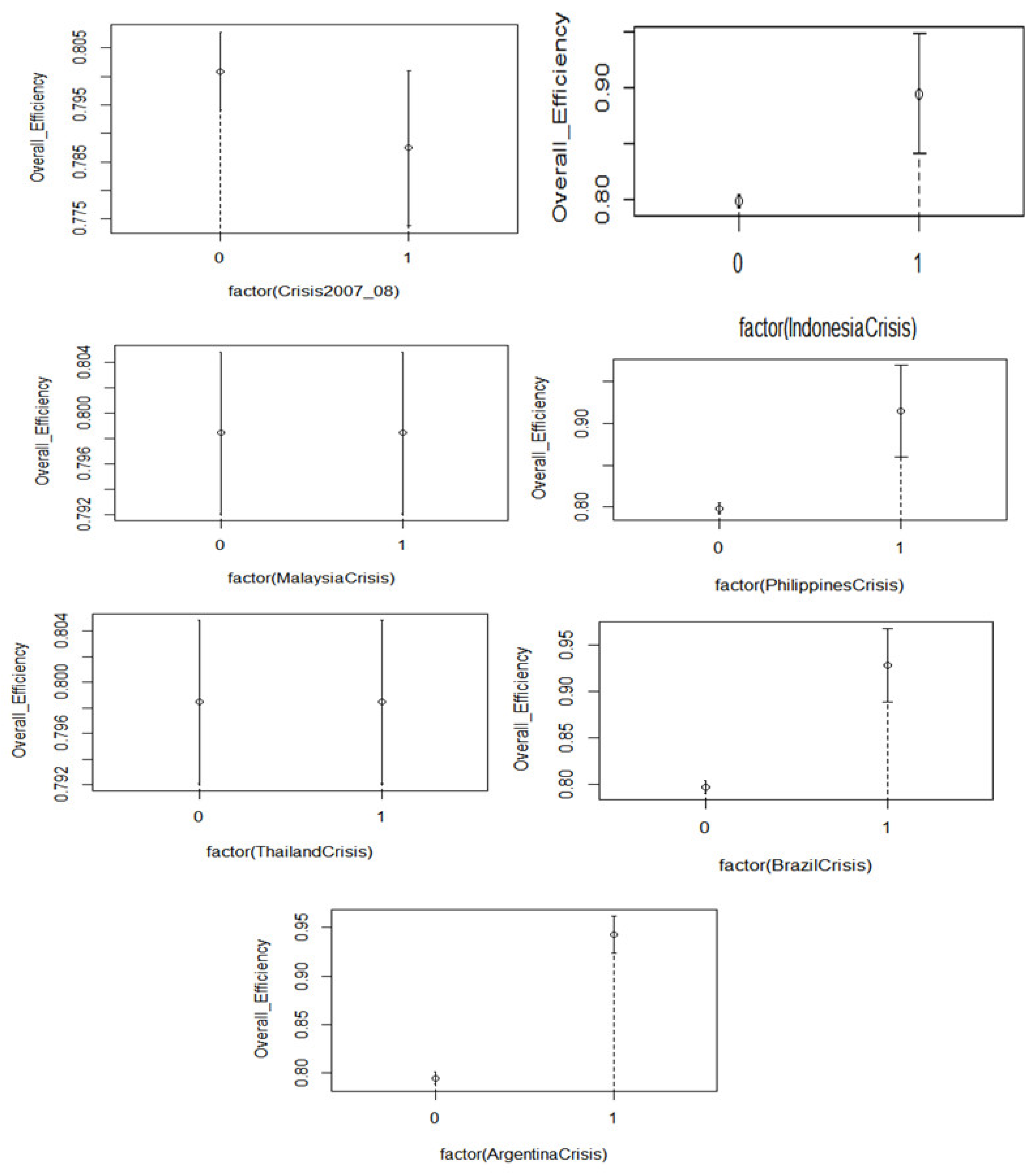

This paper is to provide literature review on traditional financial system classification and offer and alternative classification of financial systems. In the first stage we employ the bootstrap Data Envelopment Analysis DEA method to compute the efficiency of individual banks during the period 19992008. Revenue-Based Financing Revenue-Based Financing Revenue-based financing also known as royalty-based financing is a type of capital-raising method in which investors agree to provide capital to a company in exchange for a certain percentage of.

TOWARDS A SUSTAINABLE BANKING SECTORMALAYSIA. Conventional wisdom holds that there are basically 2 types of financial systems bank-based and market-based. 10 in accordance with the International Standard Industrial Classification of All Economic Activities ISIC Revision 2008.

Table 120 Data as at Jan 2019. 2 IOSCO 2014 Market-Based Long Term Financing Solutions for SMEs and Infrastructure Report to G20 Finance Ministers and Central Bank Governors. The paper follows Simar and Wilsons 2007 two-stage procedure to analyze the efficiency of the Malaysian banking sector.

At the domestic front the Islamic banking asset stood at US125 billion in 2012. TYPES OF FINANCING AVAILABLE Depending on your project you may have many financing options available including. Eco-system of Institutions for Talent Development for the Financial Sector in Malaysia Fees of Basic Banking Services in Malaysia Evolution of the Malaysian Financial Sector Progress Made in Achieving the Financial Sector Blueprint Targets Malaysias Selected Financial Inclusion Indicators 13 15 25 27 30 47 62 List of Tables List of Boxes Box.

Understanding the development process and timeline helps us get a clear map when building a real estate project finance model. This is to ensure the continuation of the project until completion. 3 and a separate guidance will be developed for the securities sector.

Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. Ous types of exposures and to have a mechanism. The last seen of Malaysias economic contracted was in 2009 -15 and this is the lowest contraction after 1998 -74.

The sector classification does not refer to the type of goods or services provided by the donor. Wide micro-financing scheme2 by the Central Bank of Malaysia CBM has also increased the role of banks in providing access to financing for viable micro enterprises. Amid the rapid growth of the industry globally Malaysia has been at the forefront with total Islamic asset accounting for nearly 13 of the global Islamic finance industry and 8 of the global Islamic banking assets Ernst and Young 2013 SESRIC 2012.

Also includes the provision of steam and air conditioning supply. Before the 1997 financial crisis the Malaysian banking system consisted of a financial sector which was fragmented and under-capitalized. At end-2014 commercial bank loans to SMEs accounted for 943 of total loans extended to SMEs.

In 2020 various Movement Control Order MCO phases were implemented in the country since 18 March 2020 until now to. Mat-Nor 2006 states that the plan to consolidate and rationalize the banking sector was initiated as early as mid 80s when the industry was badly hit by the 1985-1986 economic recession. Real Estate Project Finance Development Timeline.

Agriculture Hunting Forestry and Fishing refers to loans granted for the. BL for all types of property development catered for developers.

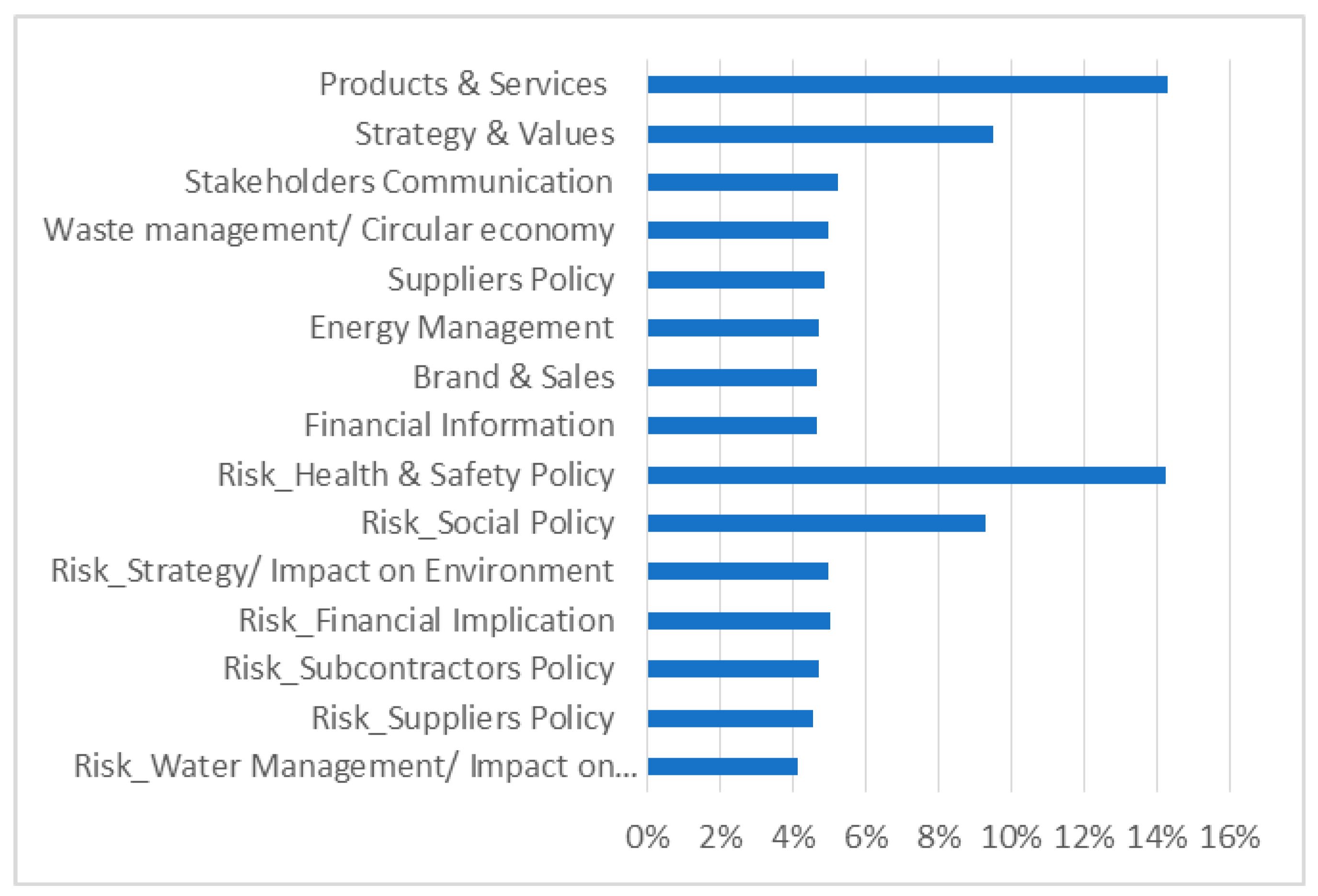

Risks Free Full Text Risk Information In Non Financial Disclosure Html

Pdf Financial Risk Assessment And Management By Banks Evidences From Past Research

Jrfm Free Full Text Incorporating Credit Quality In Bank Efficiency Measurements A Directional Distance Function Approach Html

Role Of Commercial Banks In Economic Development Library Information Management

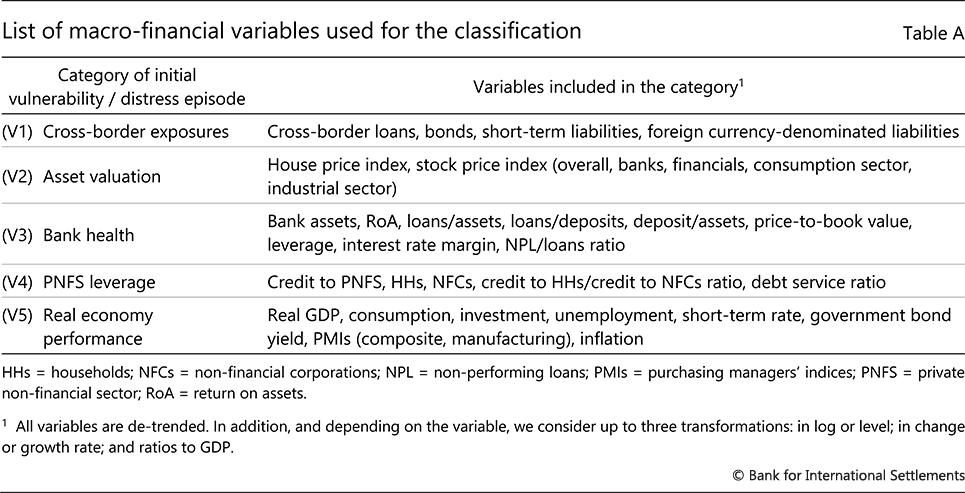

Tools For Managing Banking Distress Historical Experience And Lessons For Today

Three Tiered Banking Management Information System Source Sap 2011 Download Scientific Diagram

Case Study Is Every Business Request A Project Pmi

Pdf Innovations And Sustainability In The Financial And Banking Sectors

0 Response to "financing project type classification method in banking sector in malaysia"

Post a Comment